Bottom Line Up Front: Choosing the right art business structure is crucial for your success. Most artists start as sole proprietors by default, but LLCs offer the best balance of liability protection and tax simplicity for growing art businesses. Corporations are typically only necessary for larger operations with multiple employees or significant revenue.

The Art Business Structure Dilemma

Every successful artist faces a crucial crossroads: when to transition from selling art casually to running a legitimate business. The art business structure you choose affects everything from your taxes to legal protection and business credibility. You may have already opened an online store, started selling on platforms, or sold your work to family or friends. At this point, the government considers you a “sole proprietor”. But is this the right art business structure for your growing art practice?

The choice between sole proprietorship, LLC, and corporation isn’t just about paperwork—your art business structure affects your taxes, legal protection, and business credibility. Being a professional artist involves more than being skilled with paints or clay—you actually become a small business owner.

This comprehensive guide will help you understand each art business structure’s pros and cons, so you can make an informed decision that protects your art, your assets, and your future. Whether you’re just starting to turn your passion for art into a business or you’re already selling your art online, choosing the right art business structure is crucial.

Understanding Your Art Business Structure Options: The Big Three

Sole Proprietorship: The Default Starting Point

What It Is: A sole proprietor is someone who owns an unincorporated business by themselves. This would be the most used form of organization by an artist.

How It Works: Most visual artists are considered “self-employed” in regards to filing their taxes. In a legal and taxpaying sense, this means that your “business” as an artist, and you as an individual taxpayer, are one and the same.

Key Characteristics:

- No legal separation between you and your business

- The sole proprietor can consist of husband and wife. This is the only form of organization that does not require an annual review and fee with the Secretary of State

- Simplest structure to start and maintain

- You’re already operating as one if you’re selling art

Limited Liability Company (LLC): The Artist’s Sweet Spot

What It Is: An LLC (limited liability company) is a popular business entity for artists that provides enhanced liability protection for you as the owner— as well as the tax benefits of a partnership.

How It Works: An LLC is considered a separate legal entity from its members. Under most circumstances, the business owner’s personal assets are protected in the event of a lawsuit against the company or if the LLC runs into financial problems and cannot pay its debts.

Key Characteristics:

- Legal separation between personal and business assets

- Pass-through taxation (profits/losses flow to personal tax return)

- LLCs may have an unlimited number of members, which allows for growth if a business owner wants to bring on additional partners to expand the business

- More credible to clients and galleries

Corporation: The Formal Business Structure

What It Is: A C Corporation is a separate tax and legal entity from its owners (shareholders). Incorporating is more involved and costs more than forming an LLC. However, it offers the highest degree of personal liability protection.

How It Works: Corporations can be structured as C-Corps (with double taxation) or S-Corps (with pass-through taxation and specific restrictions).

Key Characteristics:

- Highest level of liability protection

- More complex tax filing requirements

- Most professional artists start an art business to avoid the corporate lifestyle, so they might be hesitant to form their own corporation

- Best for larger operations with multiple employees

Deep Dive Comparison: Which Art Business Structure Fits Your Practice?

Liability Protection Analysis

Sole Proprietorship Risk: However, sole proprietors are liable for any legal or financial problems that occur. So, unless the artist has professional liability insurance, there is no protection from any potential liabilities. Business and personal assets are at risk to potential creditors.

Real-World Scenario: Say you have a print that incorporates a saying from a song or a movie that becomes popular. When you receive a cease and desist letter from that artist’s lawyers to stop creating that print as well as pay a fine, you will want to be protected by an LLC. This is where understanding copyright and intellectual property becomes crucial for protecting your art business.

LLC Protection: If you have already set your business up as an LLC and you happen to be fined or taken to court, the courts can only take from your business assets and bank accounts—they cannot use your personal assets such as your car or home to help settle the damages.

Tax Implications Breakdown

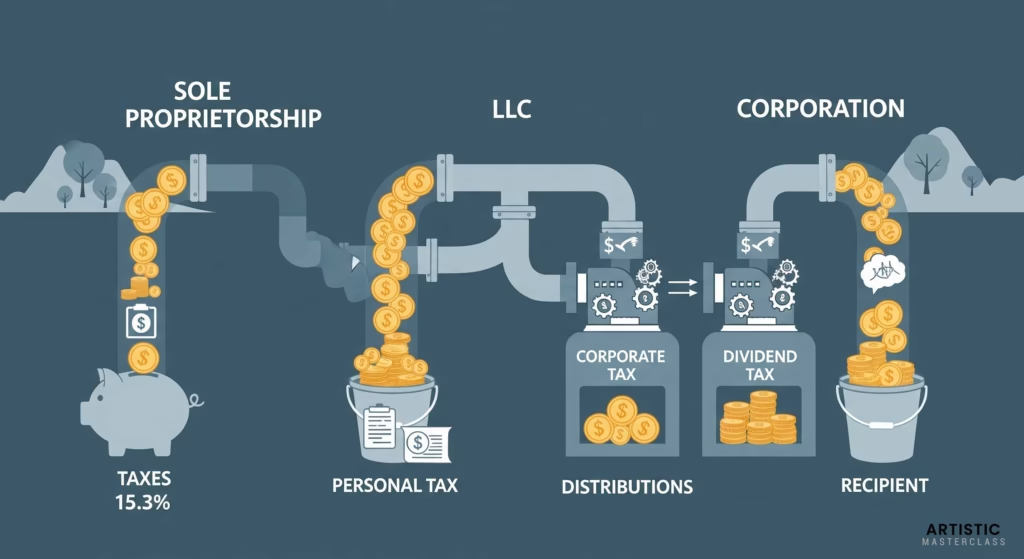

Sole Proprietorship Taxes:

- You will likely have to pay self-employment taxes and estimated quarterly taxes. In addition to your annual return, you will need to file quarterly

- The sole proprietor files an individual tax return and is subject to self employment tax (Social Security and Medicare of 15.3%)

- All business income taxed as personal income

LLC Tax Benefits:

- The IRS and most other tax authorities consider an LLC a “disregarded entity” for tax purposes. In other words, the LLC does not report and pay tax, but rather business income and losses pass through to the LLC members’ personal tax returns

- Unlike sole proprietorships, LLCs have the option of electing to be taxed as a corporation instead

- As an S Corp, owners maintain pass-through taxation but only pay Social Security and Medicare taxes on income paid as members’ salaries and wages. Any business profits paid to members as distributions are not subject to self-employment taxes

Corporation Tax Considerations:

- C-Corps face double taxation (corporate and individual levels)

- S-Corps offer pass-through taxation with restrictions

- More complex filing requirements

Professional Credibility Factor

The LLC Advantage: Registering as an LLC also offers your business some legitimacy. You’d be surprised how many collectors, gallerists, and clients start to take notice once you sign emails or print business cards with your business name followed by “LLC”.

Name Protection: Once you register, your business name is protected so that no one else can sell art under that name. This is especially important to protect your brand from unscrupulous competitors who might want to profit from your name recognition.

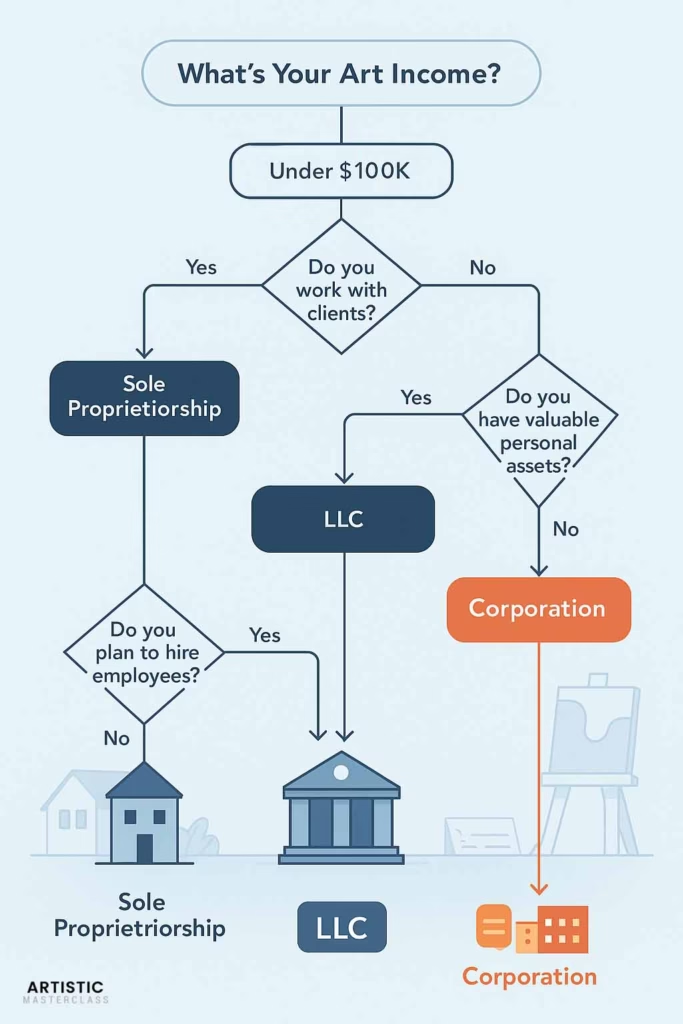

When to Choose Each Art Business Structure

Stick with Sole Proprietorship If:

- You’re just starting to sell art occasionally

- Your art practice generates minimal income (under $10,000 annually)

- You primarily sell to friends and family

- You’re comfortable with unlimited personal liability

- You want the simplest tax filing process

Upgrade to LLC When:

- If you’re concerned about potential lawsuits or debts, an LLC makes the most sense for you

- You’re generating consistent art income through online sales platforms

- You work with clients, galleries, or participate in art shows

- You want professional credibility when working with galleries

- You’re considering bringing in partners

- You have valuable personal assets to protect

- You’re regularly taking on art commissions

Consider Corporation If:

- Your art business generates substantial revenue (typically $100,000+)

- You plan to hire employees

- You need to raise capital from investors

- You are conducting business in more than one state

- You want the highest level of liability protection

The Art Business Structure Setup Process: Step-by-Step Guide

Setting Up a Sole Proprietorship

- No formal paperwork required – you’re automatically a sole proprietor when you start selling

- Get necessary permits – If you are selling any artwork yourself, it is a legal requirement to have a business license

- Obtain resale permit if selling physical goods

- Set up business banking (recommended but not required)

- Register DBA if using a business name different from your legal name

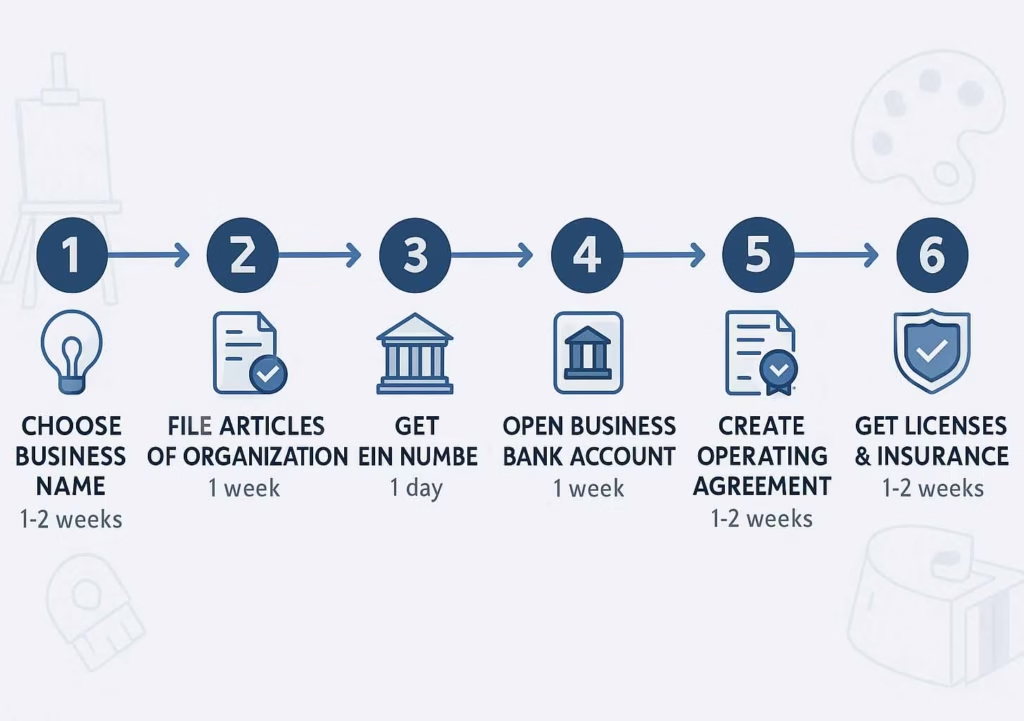

Forming an LLC

- Choose and verify business name availability

- File Articles of Organization with your state

- Create Operating Agreement (recommended)

- Obtain EIN from the IRS

- Open business bank account

- Get required licenses and permits

- Consider business insurance

Cost Considerations: To start an LLC, you need to register with your state and pay a fee. Some states require annual fees to maintain your LLC status.

Incorporating Your Business

- File Articles of Incorporation with your state

- Create corporate bylaws

- Hold initial board meeting

- Issue stock certificates

- Obtain EIN and necessary licenses

- Set up corporate bank account

- Maintain corporate formalities (annual meetings, records)

Tax Deductions: What You Can Write Off

Regardless of your art business structure, artists can deduct numerous business expenses:

Common Art Business Deductions:

- Art materials and supplies

- Studio rent and utilities

- Professional development and education

- Travel to art shows and exhibitions

- Marketing and advertising costs

- Professional fees (accountant, lawyer)

- Equipment and software

Important Tax Tip: The Tax Cuts and Jobs Act established a brand new deduction that allows owners of pass-through businesses, including artists, to deduct an amount equal to up to 20% of their net income from the business.

Business vs. Hobby: IRS Guidelines

Critical Distinction: Your art practice is defined as a business if you have the intention to sell your work regularly for profit and a hobby is done without financial incentive.

IRS Business Test: You must decide if your artistic endeavor is a company or a hobby for tax purposes in order to comply with the IRS. The IRS considers these factors:

- Whether you conduct the activity professionally

- Time and effort invested to make it profitable

- Dependence on income from the activity

- Success in similar activities

- Knowledge required to conduct the activity profitably

Profit Expectation: As a general rule of thumb, your business should be making a profit for at least three out of five years.

Common Mistakes to Avoid

LLC-Specific Pitfalls

Asset Commingling: You’ll need to be super diligent about keeping your personal funds separate from your business funds and tracking everything, since intermingling your personal and business money in an LLC could result in you losing your limited liability protection.

Record Keeping Failures

- Not tracking business expenses properly

- Mixing personal and business transactions

- Failing to maintain corporate formalities (for corporations)

- Not filing quarterly estimated taxes

Legal Oversights

- Operating without proper licenses

- Not protecting intellectual property

- Inadequate insurance coverage

- Ignoring state-specific requirements

Making the Art Business Structure Transition: When to Upgrade

Signs It’s Time to Form an LLC

- Consistent monthly art sales through online platforms

- Working with galleries or art dealers

- Participating in art fairs and exhibitions

- Hiring assistants or collaborators

- Accumulating valuable personal assets

- Receiving client contracts worth $5,000+

- Building a professional art portfolio for serious buyers

Red Flags That Demand Immediate Action

- Potential copyright infringement issues

- Working with high-value collectibles

- Operating in multiple states

- Planning to seek investors

- Facing increased liability exposure

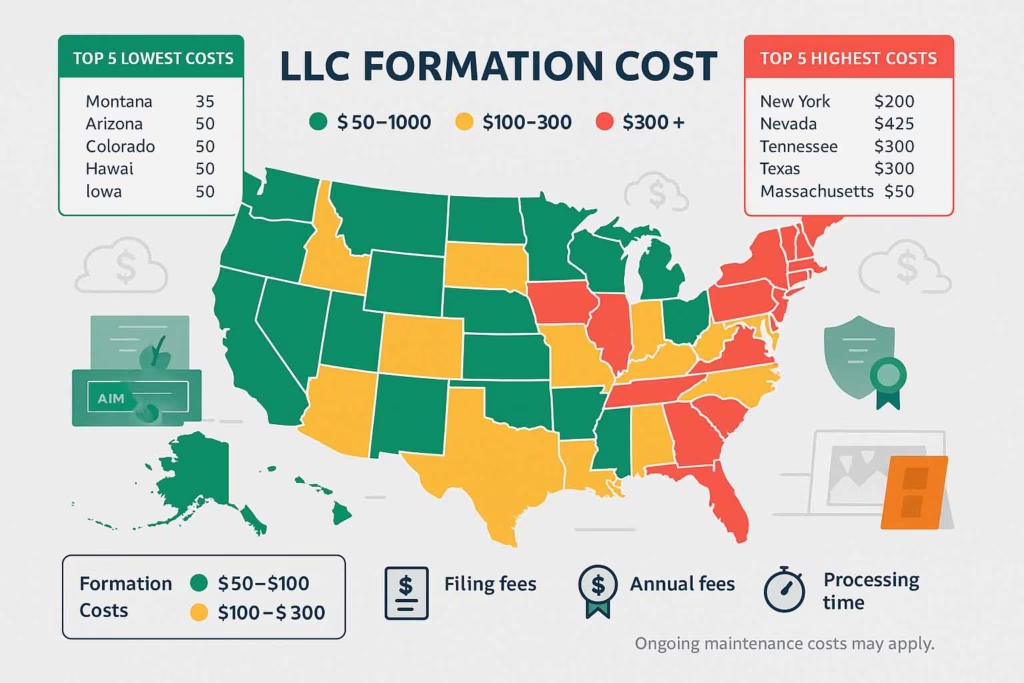

State-by-State Considerations

LLC Formation Costs Vary Widely:

- Some states charge as little as $50 to form an LLC

- Others charge $500+ with annual fees

- Forty-four states levy a corporate income tax, with top rates ranging from a 2.25 percent flat rate in North Carolina to a 11.5 percent top marginal rate in New Jersey

Key State Factors:

- Filing fees and annual maintenance costs

- Tax implications and rates

- Required formalities and reporting

- Time to process applications

Professional Support: When to Hire Help

Essential Professional Services

Legal Counsel: It is important to have professional legal counsel before making any legal decision related to your business

Tax Professional: Given the complexity of art business taxation, especially with changing laws, professional tax advice is invaluable. The IRS provides specific guidance for artists regarding business structures and tax implications.

Business Insurance Agent: To properly protect your art, equipment, and liability exposure.

DIY vs. Professional Setup

DIY Options: You can use LegalZoom or a similar service for the registration process, or have a lawyer prepare it for you

When to Hire Professionals:

- Complex business arrangements

- Multiple state operations

- Significant revenue or assets

- Partnership structures

- IP-intensive businesses

Future-Proofing Your Art Business

Scalability Considerations

LLC Flexibility: LLCs can easily adapt as your business grows, allowing for multiple members, different management structures, and various tax elections.

Exit Strategy Planning: Consider how your chosen structure affects potential sale, inheritance, or dissolution of your art business.

Technology and Digital Considerations

Modern art businesses must consider:

- E-commerce platform integrations and choosing the best platforms to sell art online

- Digital art and NFT implications

- International sales and tax obligations

- Online marketplace requirements

- Professional photography of artwork for digital marketing

Actionable Next Steps

Immediate Actions (This Week)

- Assess your current situation – Calculate annual art income and evaluate liability exposure

- Research your state’s requirements – Look up LLC formation costs and business license requirements

- Separate business finances – Open a dedicated business bank account

- Document business activities – Start tracking all art-related income and expenses

30-Day Goals

- Consult professionals – Meet with a business attorney and CPA familiar with artist businesses

- Choose your structure – Make a decision based on your research and professional advice

- File necessary paperwork – Submit formation documents if moving beyond sole proprietorship

- Update business systems – Ensure accounting and record-keeping support your new structure

Long-term Planning (6-12 Months)

- Review and adjust – Evaluate how your chosen structure is working

- Plan for growth – Consider how business expansion might affect your structure choice

- Annual compliance – Establish systems for ongoing legal and tax obligations

Key Takeaways for Art Business Success

The Bottom Line: If your risk of lawsuits or debt is low, you may prefer a sole proprietorship. You can also always change your business structure. It’s very easy to start out as a sole prop and register later to become an LLC.

Most Important Considerations:

- Liability Protection: LLCs provide crucial asset protection for working artists

- Tax Efficiency: Proper structure choice can save thousands in taxes annually

- Professional Credibility: Business formation enhances your reputation with clients and galleries

- Growth Flexibility: Choose a structure that can evolve with your art practice

Remember: The “perfect” business structure is the one that fits your current needs while providing room to grow. Most artists benefit from starting simple and upgrading as their practice develops.

Next Steps in Building Your Art Business

Once you’ve chosen your business structure, focus on these essential areas:

- Building a professional art portfolio that showcases your best work

- Taking high-quality photos of your artwork for professional presentation

- Understanding copyright and intellectual property protection for your creative works

- Developing systems for managing art commissions professionally

Your art business structure is just the foundation—success comes from combining legal protection with strategic business development and professional presentation of your artwork.