How to price your art correctly is the most critical decision for building a successful art career. The art world is experiencing a pricing revolution, and artists who master data-driven pricing strategies are seeing remarkable results. Gone are the days when artists could rely solely on “gut feeling” or arbitrary formulas to price their work. In 2025, successful artists are embracing market intelligence, collector psychology, and advanced analytics to optimize their pricing and build sustainable careers.

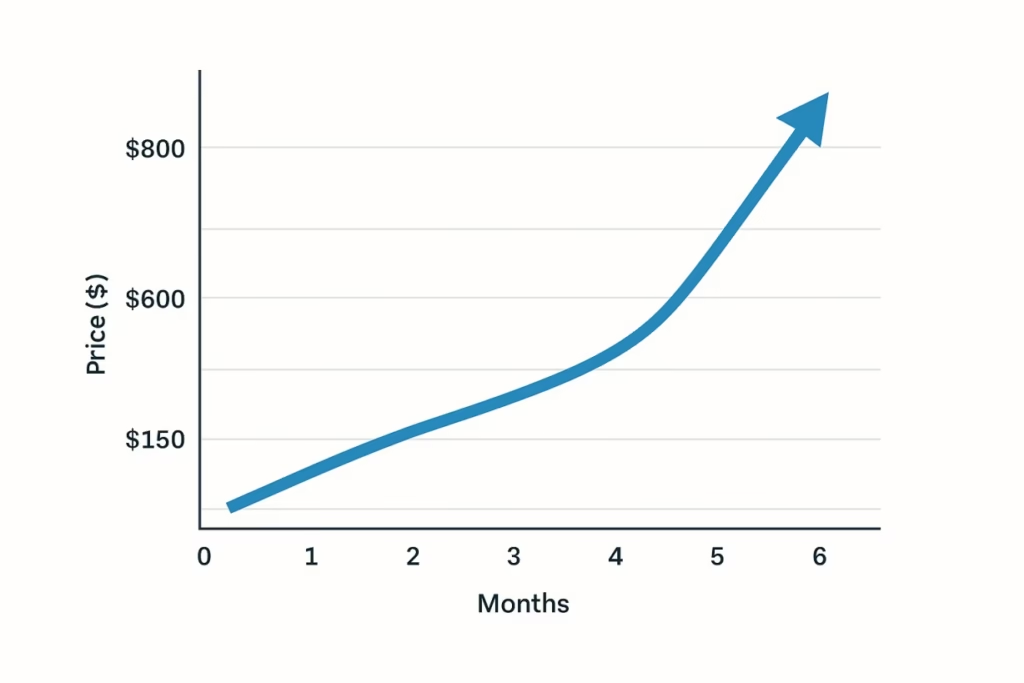

Learning how to price your art correctly can transform your entire career. Sarah Chen discovered this after two years of selling her abstract paintings at weekend markets for $150 each. Through market research, she found that comparable artists were commanding $800-1,200 for similar work. The problem wasn’t her art—it was her pricing approach. Within six months of implementing a data-driven strategy for how to price your art, Sarah’s average sale price increased by 340%, and she landed representation with a respected gallery.

Sarah’s transformation didn’t happen in isolation. She also invested in professional photography of her artwork and learned how to turn her passion for art into a sustainable business. But pricing was the foundation that made everything else possible.

Sarah’s story isn’t unique. Across the art world, a transparency revolution is creating unprecedented opportunities for artists willing to move beyond guesswork and embrace market intelligence.

Why Learning How to Price Your Art Matters More Than Ever

The traditional approach to pricing art—mixing emotional attachment with basic square-inch formulas—is failing artists in today’s competitive market. Recent research reveals that 72% of art collectors want transparent pricing information, yet only 44% of galleries display prices online for all available works. This gap between collector expectations and industry practice has created both a challenge and an opportunity.

Artists who price their work based purely on emotion or outdated formulas often fall into predictable traps. Learning how to price your art correctly means avoiding these common mistakes. They either underprice from fear of rejection, leaving money on the table, or overprice due to attachment, pricing themselves out of their market. Neither approach builds the kind of collector confidence that sustains a career.

Consider the numbers behind today’s art market. The global art market represents approximately $1.7 trillion in privately held assets, with only $65 billion trading annually. That’s just 4% of total value. This massive illiquidity creates pricing inefficiencies that informed artists can navigate more successfully than those relying on intuition alone.

Why 2025 Demands a New Approach

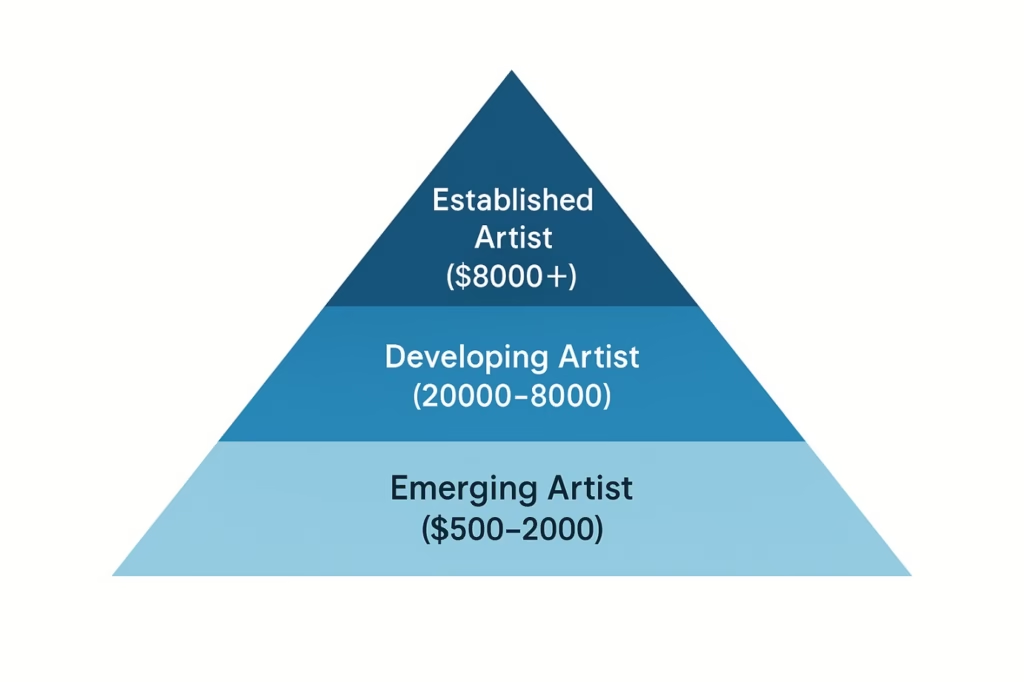

Three fundamental shifts have made data-driven pricing essential for today’s artists. First, the definition of “emerging artist” pricing has exploded upward. What was once a $10,000 ceiling for emerging work has surged to $30,000-45,000. This dramatic shift has scrambled traditional pricing signals, making market data crucial for accurate positioning.

Second, online art sales continue growing, with 59% of collectors purchasing art online in 2024. Digital platforms demand pricing transparency and consistency across channels. When collectors can easily compare prices across multiple platforms, inconsistencies undermine credibility and sales potential. This makes choosing the right platforms to sell your art online crucial for maintaining pricing integrity.

Third, today’s collectors have access to comprehensive databases like Artnet’s 18 million auction results and AI-powered valuation tools. They’re making informed decisions and expect artists to demonstrate similar market awareness. The days of mysterious pricing are ending.

The Market Intelligence Approach

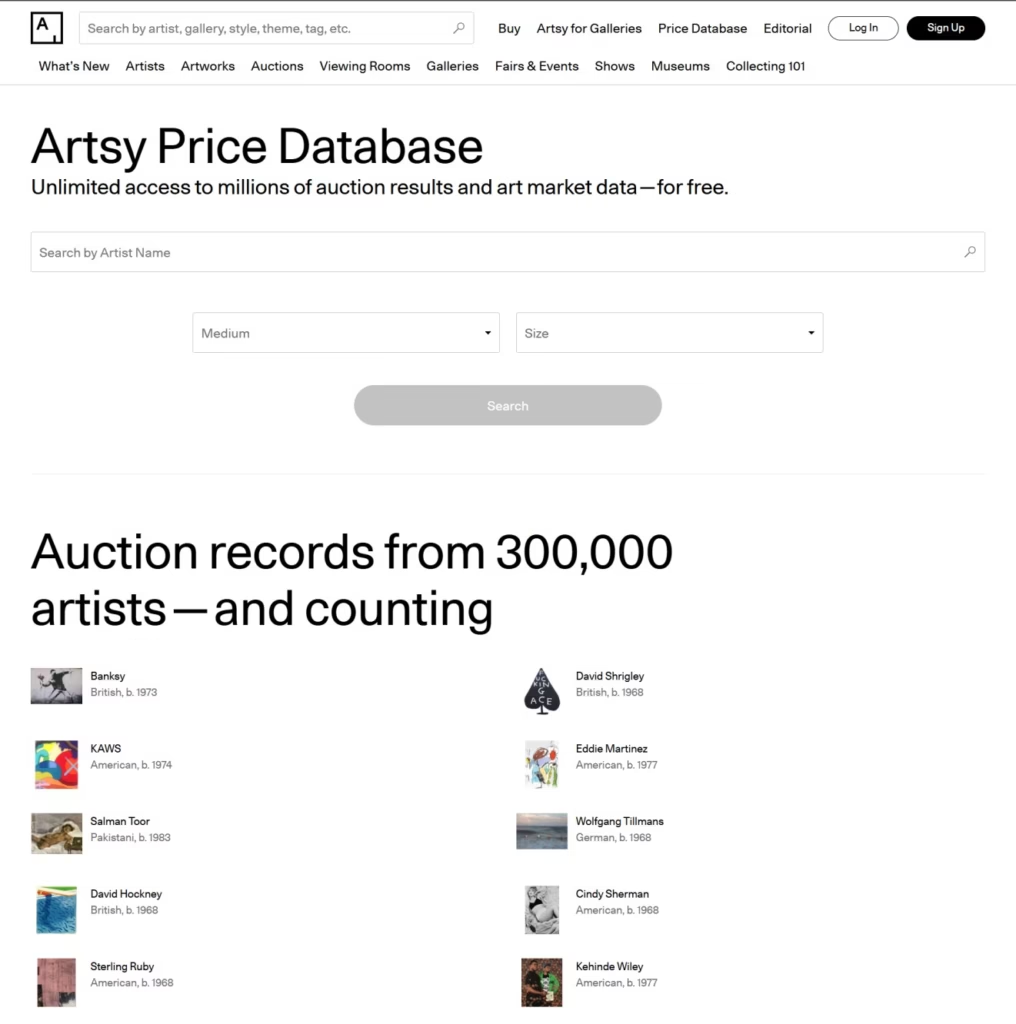

Understanding how to price your art in 2025 requires grasping the multiple factors that influence collector decision-making. The most transparent data comes from auction houses, where hammer prices provide clear market benchmarks. Platforms like Artnet, Artsy’s free price database, and LiveArt offer access to millions of verified sales results that can inform your pricing decisions.

Your gallery representation significantly impacts pricing power. Research shows that gallery-represented artists can command 50-200% higher prices than unrepresented peers, but this comes with considerations. Most galleries take a 50% commission, so your pricing must account for both your desired net income and the gallery’s cut. Understanding these dynamics is essential, especially as you build a successful art portfolio that attracts gallery attention.

Digital presence has become another crucial factor. Artists with strong online followings can justify premium pricing through demonstrated audience engagement. This includes not just Instagram followers, but website traffic, email list engagement, and press mentions. The data shows a clear correlation between digital presence and pricing power. However, your online presentation must be professional—high-quality photos can significantly elevate your art career and directly impact what collectors are willing to pay.

Institutional validation provides perhaps the strongest pricing support. When museums acquire work by artists at your career level, it creates powerful market signals that collectors recognize and value. Tracking these patterns helps position your work within the appropriate price range.

How to Price Your Art Using Enhanced Formulas

Traditional square-inch pricing gets an upgrade when you learn how to price your art with market intelligence. Instead of simply multiplying height times width times an arbitrary rate, smart artists in 2025 are using market-adjusted formulas that account for real-world variables.

The enhanced approach starts with the basic calculation but applies market adjustment coefficients. Regional demand varies significantly—work in major art hubs like New York or Los Angeles can command 20-40% premiums over national averages, while secondary markets often price 15-30% below major centers. Medium popularity also fluctuates with market trends, and even seasonal factors affect pricing, with many collectors making purchases during art fair seasons.

For artists who prefer linear-inch pricing—adding height plus width rather than multiplying them—the same market intelligence principles apply. The key difference is that linear pricing creates less dramatic price variations between small and large works, which can be preferable for artists building collector relationships gradually.

Your reputation factor, the multiplier that reflects your career development, should be based on objective criteria rather than self-assessment. Emerging artists typically work with factors between 1-3, while developing artists who’ve shown consistently for several years might use factors of 2-5. Established artists with strong gallery representation and secondary market activity can justify factors of 4-8 or higher.

When learning how to price your art, the most successful artists document their methodology clearly. When collectors ask about pricing, they can confidently explain their market research and data sources rather than appearing arbitrary. This transparency builds trust and positions you as a serious professional.

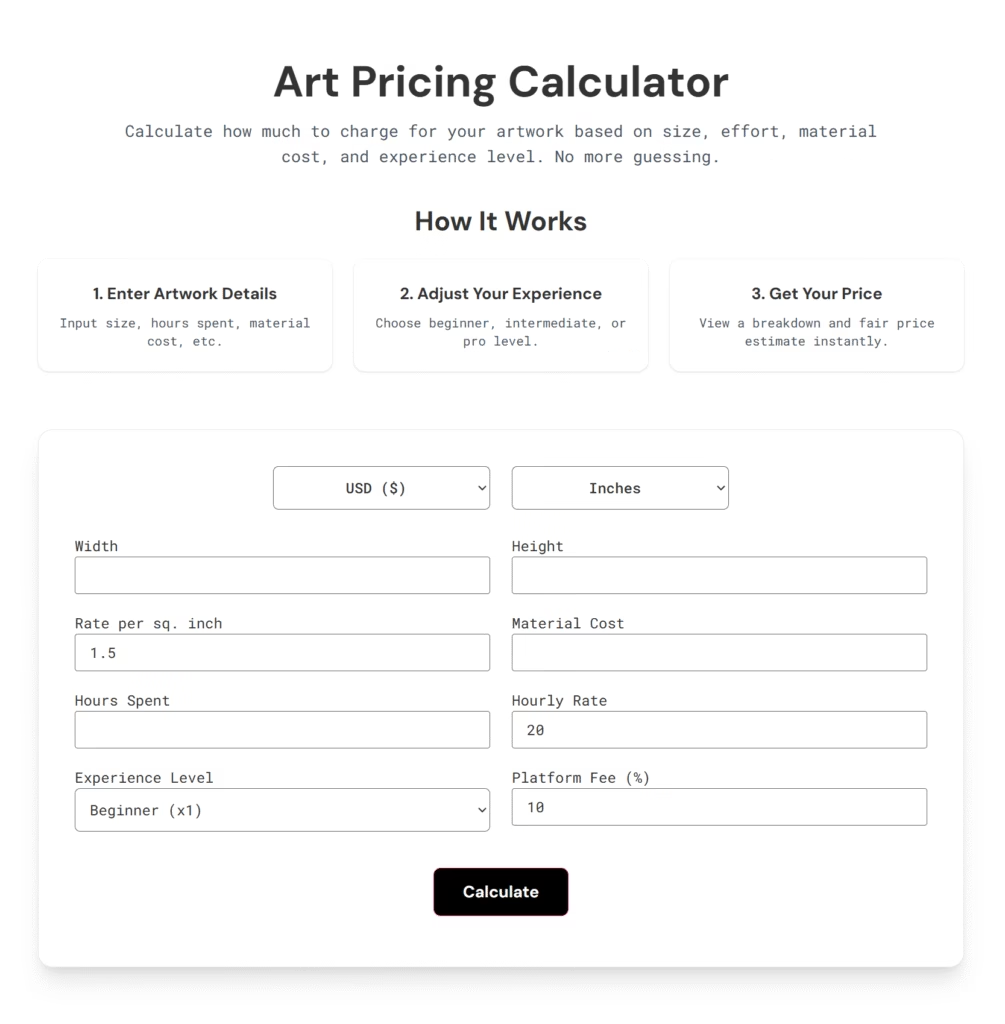

To help you implement these strategies immediately, we’ve created a comprehensive art pricing calculator that incorporates the market intelligence principles discussed in this guide. This tool combines traditional formulas with modern market adjustments to give you data-backed pricing recommendations.

The Psychology Behind Collector Behavior

Understanding how collectors think about pricing gives you a significant advantage. Collectors use reference points to evaluate art value, so presenting your prices alongside comparable market data creates powerful anchoring effects that justify your pricing decisions.

Research in pricing psychology reveals interesting patterns in how people respond to different price formats. For smaller works and prints targeting new collectors, charm pricing like $49 or $199 can be effective. However, for serious collectors and original works, authority pricing with round numbers like $1,500 or $5,000 better matches expectations and reinforces quality perceptions.

The concept of price anchoring works particularly well in art sales. When collectors see that comparable artists are selling similar work for $3,000-5,000, your price of $3,800 feels reasonable and well-positioned. Without that context, the same price might feel arbitrary or excessive.

Transparency itself has become a trust-building tool. Collectors appreciate artists who can articulate their pricing methodology rather than those who seem defensive or vague about their rates. This doesn’t mean sharing every detail of your costs, but rather demonstrating market awareness and professional approach to your business.

Regional Market Intelligence

Pricing must account for geographic differences in demand and purchasing power. Major art hubs command premium pricing but also feature greater competition and higher collector sophistication. If you’re selling in New York or Los Angeles, collectors expect you to understand market positioning and can justify higher prices, but they’ll also scrutinize your pricing more carefully.

Secondary markets offer different opportunities. Collectors in these areas often seek value and may be more price-sensitive, but they also appreciate accessibility and local connections. Emphasizing your regional relevance and building relationships can be more important than commanding top dollar.

Emerging markets require long-term thinking. Pricing for growth and market development, focusing on education and relationship-building rather than immediate profit maximization, often yields better long-term results. These markets can become incredibly valuable as they mature.

Essential Technology Tools

Today’s artists have access to sophisticated market analysis tools that were unimaginable just a few years ago. Artnet’s price database remains the gold standard, offering comprehensive auction results dating back to 1985. While professional subscriptions can be expensive, even limited access provides valuable benchmarking data.

Artsy offers free access to millions of auction records, making market research accessible to artists at any career level. Their platform shows not just hammer prices but also estimated price ranges and market trends over time.

AI-powered tools like LiveArt and Magnus analyze both visual and market factors to provide estimated values. While these tools aren’t perfect, they offer valuable market validation and can highlight when your pricing might be significantly out of line with market expectations.

The key to successfully learning how to price your art is using these tools systematically rather than sporadically. Set up regular market monitoring, track comparable artists over time, and document pricing trends in your field. This ongoing intelligence gathering informs better pricing decisions than one-time research.

Step-by-Step Implementation

The most successful transformations in how to price your art happen systematically over 30 days rather than overnight. Start by conducting comprehensive market research on 20 comparable artists at your career level. Document their price ranges by size and medium, note their gallery representation and exhibition history, and identify patterns in their market positioning.

Before diving into detailed research, use our free art pricing calculator to get an initial baseline for your work. This tool will give you a starting point based on current market data, which you can then refine through additional research.

Next, audit your current work and pricing honestly. Calculate your actual costs including materials, time, and overhead. Assess your current market position and credentials objectively. Look for pricing inconsistencies across different sales channels or work types that might be confusing collectors.

Week two focuses on framework development. Choose your primary pricing method and calculate your reputation factor using objective criteria. Determine appropriate regional and market adjustments based on your research. Test your formulas on existing work to ensure they produce logical, consistent results.

Pro Tip: Use our art pricing calculator to test different scenarios and see how various factors affect your final pricing. The calculator incorporates the enhanced formulas discussed in this guide and helps you maintain consistency across your entire body of work.

Implementation begins in week three with a soft launch approach. Update pricing on your website and portfolios, but test new prices with trusted collectors or advisors first. Prepare clear explanations for pricing questions and create FAQ responses for common concerns. Monitor initial responses carefully and make minor adjustments based on market feedback.

Week four focuses on optimization and long-term planning. Analyze early performance data, compare conversion rates to previous pricing, and identify which price points work best for your market. Establish quarterly pricing review schedules and set up systems for ongoing market monitoring.

Advanced Career Development

As your career progresses, learning how to price your art should evolve systematically. The transition from emerging to developing artist status typically involves gradual price increases of 10-20% annually, supported by growing exhibition history and sales documentation. The key is building pricing justification through measurable career progress rather than arbitrary increases.

Developing artists moving toward established status can begin commanding premium pricing through scarcity and exclusivity. This might involve limiting production, introducing special editions, or leveraging secondary market activity. Institutional relationships become increasingly important for validation at this level.

Tracking the right metrics helps optimize your approach over time. Monitor sales velocity by price range, conversion rates from inquiry to purchase, and seasonal patterns. Compare your performance to comparable artists and gather feedback from galleries about pricing competitiveness.

Building collector relationships requires thinking beyond individual transactions. When collectors understand and trust your pricing methodology, they’re more likely to make repeat purchases and refer others. This long-term approach to collector development often proves more valuable than maximizing individual sale prices. Many successful artists also supplement their original work sales with art commissions, which require their own pricing considerations.

Common Mistakes and How to Avoid Them

The biggest mistake artists make is emotional pricing. Creating art is deeply personal, but pricing must remain objective. Use your data framework to separate creative value from market value. Remember that underpricing can signal low quality to sophisticated collectors just as surely as overpricing can drive them away.

Inconsistency across platforms undermines credibility. Maintain consistent pricing or clearly explain variations. If you offer different prices for gallery sales versus direct sales, make sure the difference reflects actual cost differences like commissions rather than arbitrary decisions.

Many artists fall into the trap of following outdated advice about “struggling artist” pricing. Professional pricing reflects professional practice. While accessibility matters, consistently undervaluing your work makes it harder to invest in quality materials, studio space, and career development. It’s also worth noting that protecting your pricing integrity involves understanding copyright and intellectual property rights, especially as your work gains value.

Ignoring regional market differences leads to pricing that’s either too high for your local market or too low compared to major art centers. Always adjust national pricing averages for your specific market conditions and collector base.

Building Long-Term Success

Data-driven pricing isn’t just about maximizing individual sales—it’s about building sustainable career growth through informed decision-making. The transparency revolution in the art market rewards artists who can demonstrate market awareness and professional business practices.

The artists who thrive in 2025 and beyond will be those who combine creative excellence with market intelligence. This doesn’t mean compromising artistic vision for commercial success, but rather understanding how to position your vision effectively within the marketplace.

Your pricing strategy should support your long-term career goals rather than just immediate income needs. Sometimes this means pricing for market development rather than profit maximization. Other times it means raising prices to match your growing reputation and market position. As you develop your career, you’ll also want to consider the broader aspects of structuring your art business to support sustainable growth.

The tools and data exist to make informed pricing decisions. Market databases, AI valuation tools, and professional networks provide unprecedented access to market intelligence. The question isn’t whether this information is available—it’s whether you’ll use it to your advantage.

Your Next Steps

Start by researching five comparable artists working at your career level. Use free tools like Artsy’s price database to understand their pricing ranges and market positioning. Calculate what your work would price at using their rates as benchmarks.

Document your findings and begin testing data-informed pricing on new work. Track the results carefully, noting changes in inquiry quality, conversion rates, and collector feedback. Adjust your approach based on real market response rather than assumptions.

Remember that pricing is a skill that improves with practice and market feedback. The goal isn’t perfection from day one, but rather continuous improvement based on data and experience. Every interaction with collectors provides information that can refine your approach.

The art world’s transparency revolution creates unprecedented opportunities for artists willing to embrace market intelligence. While your competitors rely on outdated formulas and emotional pricing, you’ll have the data to make informed decisions that accelerate career growth.

Your artistic talent deserves professional pricing that reflects both market realities and your creative value. Mastering how to price your art is essential for building the sustainable art career you deserve. Start implementing these data-driven strategies today, and join the ranks of artists who’ve transformed their careers through intelligent pricing decisions.

Ready to revolutionize how to price your art? Start with our comprehensive art pricing calculator to get immediate, data-driven pricing recommendations for your work. Then implement the market research strategies discussed here and track your results. Your future collectors—and your bank account—will thank you.

Next Steps:

- Use the art pricing calculator for instant pricing guidance

- Research five comparable artists using the methods outlined above

- Document your pricing methodology for collector conversations

- Track your results and adjust based on market feedback

The combination of our pricing tool and the strategic insights in this guide gives you everything needed to price your art professionally and profitably.