The world’s most expensive living artist is back where he started—and it reveals everything about the high-stakes game of contemporary art in 2025.

Jeff Koons Gagosian return marks one of 2025’s most significant art world developments. In a move that sent ripples through the contemporary art world, Jeff Koons returned to Gagosian Gallery this week after a turbulent four-year relationship with Pace Gallery that ended in spectacular financial failure. The reunion of art’s most commercially successful artist with the world’s most powerful mega-gallery isn’t just industry gossip—it’s a revealing snapshot of how economic pressures, massive production costs, and shifting collector behavior are reshaping the entire art market ecosystem.

The Jeff Koons Gagosian Return: A Prodigal Son’s Journey

The announcement came quietly on August 27, 2025, but the implications are anything but subtle. The Jeff Koons Gagosian return represents more than just a business reunion—Koons, whose stainless steel Rabbit sculpture holds the record as the most expensive work by a living artist at $91.1 million, has rejoined the gallery that staged thirteen solo exhibitions of his work over two decades across Beverly Hills, Hong Kong, London, and New York.

The reunion wasn’t entirely unexpected. Savvy observers had been watching since May 2025, when Gagosian staged a solo presentation of Koons’ Hulk Elvis sculptures at Frieze New York. The gallery sold Hulk (Tubas), a polychromed steel work from 2004-18, for approximately $3 million—a strategic market test that apparently went well enough to warrant a full relationship revival.

This Jeff Koons Gagosian return reflects broader shifts in how top art galleries in 2025 are adapting their artist relationships to navigate economic uncertainty.

But this isn’t simply a story of artistic homecoming. The Jeff Koons Gagosian return is the culmination of a cautionary tale about ambition, financial overreach, and the brutal economics of producing art at the highest levels of the contemporary market.

Understanding the Jeff Koons Gagosian Return: The $100 Million Gamble That Failed

To understand why the Jeff Koons Gagosian return happened, you need to understand why he left Pace—and why that relationship imploded so dramatically. In 2021, Koons made headlines by departing both Gagosian and David Zwirner to join Pace exclusively, citing a desire for a “change in environment.” At the time, it seemed like a strategic move for an artist known for his meticulous control over every aspect of his career.

What happened next reveals the staggering financial realities of producing Koons-level work in today’s market. According to industry reports, Pace enlisted investors to pre-fund a new series of Meissen-inspired sculptures, sinking between $50 million and $100 million into the venture. This wasn’t unusual—Koons’ works are notoriously expensive to fabricate, requiring teams of specialized craftspeople and cutting-edge manufacturing techniques to achieve his signature mirror-polished finishes and complex forms.

But when additional fabrication demands emerged and the project required even more funding, the investors balked. The financial backers, likely expecting a more predictable production timeline and budget, found themselves facing the reality of Koons’ perfectionist approach to art-making. Rather than compromise his vision or accept financial constraints, Koons walked away from Pace entirely, leaving behind what could have been one of the most ambitious sculpture series of his career.

The failure represents more than just a business deal gone wrong—it exposes the fundamental tension between artistic ambition and financial reality that’s increasingly defining the contemporary art market. This tension is also visible in how other contemporary figurative artists are navigating similar production challenges in 2025.

What the Jeff Koons Gagosian Return Reveals About Today’s Art Market

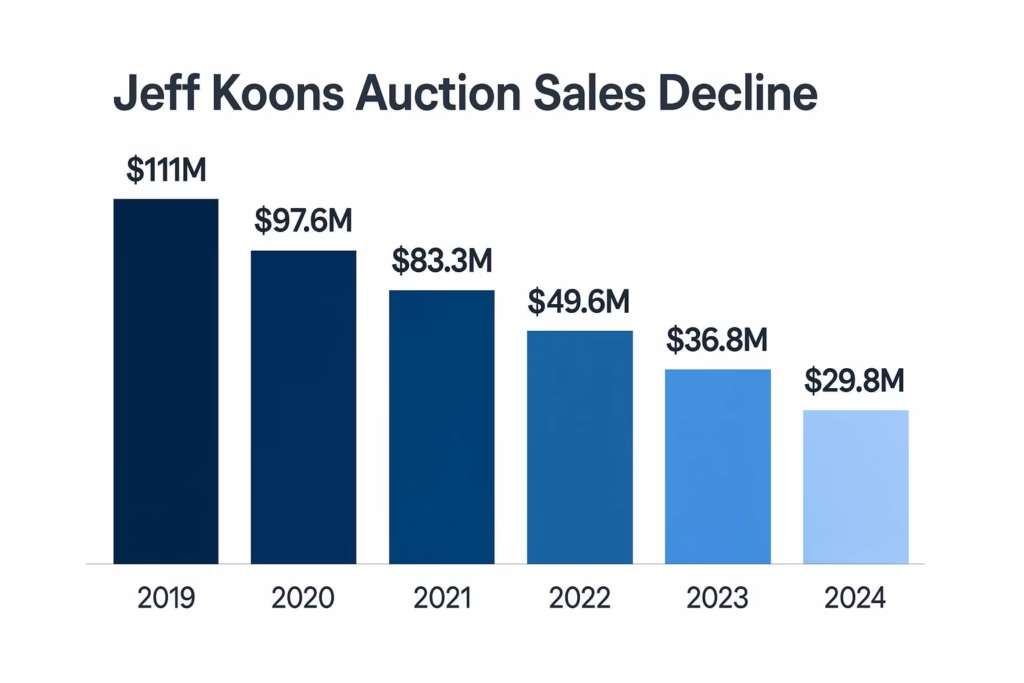

The Jeff Koons Gagosian return comes at a pivotal moment for the art world, where multiple economic and cultural pressures are forcing galleries, artists, and collectors to reassess their strategies. The numbers tell a stark story: while Koons remains the most expensive living artist at auction, his overall sales have declined dramatically, dropping from $111 million in 2019 to just $29.8 million in 2024.

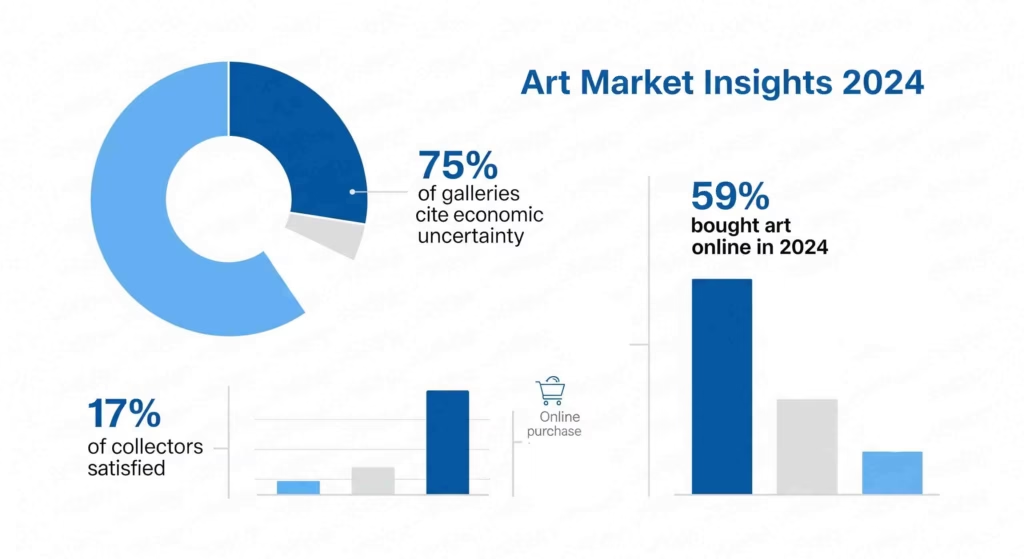

This decline isn’t happening in isolation. Across the art market, 75% of galleries identify economic uncertainty as their biggest challenge, while 60% point to changing collector behavior and reduced demand. The post-pandemic boom that saw record-breaking auction results and explosive gallery growth has given way to a more cautious, selective market where even blue-chip artists aren’t immune to broader economic headwinds.

According to Artsy’s Art Market Trends 2025 report, the shift is particularly evident in collector behavior, with only 17% of collectors believing the art market serves them well.

The shift is particularly evident in collector behavior. Recent surveys show that only 17% of collectors believe the art market serves them well, with most citing lack of price transparency and difficulty accessing quality works as primary concerns. This dissatisfaction is driving changes throughout the market, from increased online sales to more private dealing and a flight toward established, “safe” artists with proven track records.

In this environment, the Jeff Koons Gagosian return represents a strategic retreat to financial safety and established market infrastructure. It’s a recognition that in uncertain times, even the most successful artists need the resources and global reach that only the most powerful galleries can provide.

The Gagosian Advantage: Why Artists Return

Source : gagosian.com

Larry Gagosian didn’t build his art empire by accident. The gallery’s willingness to take Koons back after their 2021 split demonstrates the unique advantages that mega-galleries offer in today’s challenging market environment.

First, there’s the obvious financial capacity. Where Pace’s investors proved unwilling to fund Koons’ increasingly expensive production demands, Gagosian has the resources and experience to handle such challenges. The gallery has been financing ambitious art projects for decades, understanding that high-risk, high-reward ventures are part of the contemporary art business model.

But the advantages go beyond just having deep pockets. Gagosian’s global infrastructure—with 19 locations across major art markets—provides unmatched access to international collectors and institutions. This network becomes particularly valuable during economic uncertainty, when diversified market access can mean the difference between a successful project and a financial disaster.

The gallery’s marketing and curatorial expertise also can’t be understated. Over their previous two-decade relationship, Gagosian consistently positioned Koons’ work in museum-quality contexts, from major art fairs to institutional collaborations. The 2014 presentation of Split-Rocker at Rockefeller Center, a monumental sculpture covered with over 50,000 flowering plants, exemplified this approach—creating spectacle and cultural conversation that enhanced both the work’s artistic impact and market value.

This strategic positioning is part of a broader trend where galleries are becoming more sophisticated in how they present contemporary art, similar to movements we’re seeing with surrealism’s current renaissance in the art world.

Perhaps most importantly, Gagosian understands the long-term game that contemporary art requires. While other galleries might panic during market downturns or production delays, Gagosian has the patience and resources to weather temporary challenges while building sustained value for their artists’ work.

The Jeff Koons Gagosian return exemplifies this approach—choosing stability and proven partnership over experimental ventures.

Market Implications for Collectors Following the Jeff Koons Gagosian Return

For collectors and investors watching the Jeff Koons Gagosian return, several important signals emerge about the current state and future direction of the contemporary art market.

The most immediate implication concerns Koons’ work itself. The Jeff Koons Gagosian return likely signals renewed confidence in his market stability, particularly after the successful Frieze presentation demonstrated continued collector interest. According to Artnet’s market analysis, works from established series like Celebration, Hulk Elvis, and Gazing Ball may see renewed attention as the gallery leverages its global network to place pieces with major collectors.

However, collectors should also note the broader trend toward established, “blue-chip” artists that the Jeff Koons Gagosian return represents. In uncertain economic times, both galleries and collectors are increasingly focusing on artists with decades-long track records rather than emerging or mid-career talents. This flight to safety creates opportunities for those willing to invest in proven artists but may limit options for collectors interested in discovering new voices.

This trend is part of a larger pattern where collectors are becoming more strategic about their acquisitions, similar to how they approach other contemporary art movements gaining momentum.

The pricing dynamics are particularly interesting. While Koons’ auction results have declined from their 2019 peak, the Jeff Koons Gagosian return could stabilize prices by ensuring better market support and strategic placement of works. The $3 million price point for the Frieze Hulk piece suggests a recalibration toward more accessible (by Koons standards) pricing that could attract a broader collector base.

For collectors focused on contemporary art more broadly, Koons’ experience offers important lessons about the relationship between production costs, market demand, and long-term value. Works requiring complex fabrication and ongoing maintenance costs—increasingly common in contemporary practice—may face similar challenges as economic pressures mount.

The Future of Artist-Gallery Relationships: Lessons from Jeff Koons Gagosian Return

The Jeff Koons Gagosian return illuminates broader changes in how artists and galleries structure their relationships in an increasingly complex and expensive art market. The traditional model of exclusive representation is being tested by rising production costs, global market demands, and changing collector expectations.

One emerging trend is the rise of hybrid representation models, where artists work with multiple galleries for different markets or project types. While the Jeff Koons Gagosian return appears to represent exclusive representation (notably not rejoining David Zwirner this time), other high-profile artists are experimenting with more flexible arrangements that provide access to different types of expertise and market reach.

The financial aspect is becoming increasingly central to these relationships. As production costs for ambitious contemporary works continue to rise—driven by both artistic ambition and inflation in specialized manufacturing—galleries must increasingly function as development partners rather than just sales agents. This evolution requires new models for risk-sharing, profit-splitting, and long-term planning that many galleries are still developing.

Technology is also reshaping these dynamics. The growth in online sales—59% of collectors purchased art online in 2024—is creating new opportunities for artists to reach collectors directly, potentially reducing dependence on traditional gallery structures. However, for artists like Koons who create large-scale, experiential works, physical gallery spaces and established collector relationships remain crucial.

The rise of digital art forms and phygital art experiences is also changing how galleries think about representation and exhibition strategies.

The international dimension adds another layer of complexity. As geopolitical tensions create new barriers to global art trade, galleries with strong international infrastructure become even more valuable partners for artists seeking worldwide market access. This trend likely influenced the Jeff Koons Gagosian return to the gallery’s global network rather than working with a more regionally focused gallery.

What’s Next: Predictions for 2025 and Beyond

Looking ahead, several trends suggested by the Jeff Koons Gagosian return are likely to accelerate throughout 2025 and beyond.

Gallery Consolidation: The advantages demonstrated by mega-galleries like Gagosian in supporting high-production-value artists will likely drive further consolidation in the gallery sector. The Art Basel UBS Art Market Report 2025 shows that smaller galleries may increasingly focus on emerging artists or specific niches, while established artists gravitate toward galleries with global infrastructure and deep financial resources.

Production Economics: The failure of the Pace partnership highlights growing tensions between artistic ambition and financial reality. Expect to see new models emerge for funding complex art projects, possibly including more direct collector participation in production costs or alternative financing structures.

Market Stabilization: As economic uncertainty continues, the flight toward established artists like Koons will likely accelerate. This could create a two-tier market where blue-chip artists see stable or growing demand while emerging and mid-career artists face increased challenges. This trend is already visible in how collectors are approaching contemporary figurative art and other traditional forms.

Digital Integration: Even as physical gallery relationships remain crucial for artists like Koons, expect continued integration of digital platforms for discovery, education, and even sales. The challenge will be maintaining the experiential quality that makes contemporary art compelling while leveraging technology’s reach and efficiency.

Collector Evolution: The generational shift in art collecting—with younger, more digitally native collectors entering the market—will continue to pressure galleries to become more transparent and accessible. This trend may ultimately benefit established artists like Koons, whose work has broad cultural recognition beyond traditional art world circles.

The Bottom Line: What the Jeff Koons Gagosian Return Means

The Jeff Koons Gagosian return is more than just an art world reunion—it’s a strategic response to the economic and structural challenges reshaping the contemporary art market in 2025. The move reveals how even the most successful artists must adapt to changing financial realities, while galleries increasingly function as comprehensive business partners rather than just sales agents.

For the art market as a whole, the Jeff Koons Gagosian return signals a period of consolidation and risk management that prioritizes established relationships and proven track records over experimental ventures. While this trend may limit opportunities for emerging artists and smaller galleries, it also suggests a maturing market that’s learning to balance artistic ambition with financial sustainability.

As collectors, galleries, and artists navigate this evolving landscape, the lessons from the Jeff Koons Gagosian return are clear: in an uncertain world, sometimes the best strategy is returning to what works. Whether that approach will ultimately benefit or limit the art world’s creative vitality remains to be seen, but for now, the king of contemporary art is back where he belongs—and the market is watching closely to see what comes next.

The contemporary art market continues to evolve rapidly, driven by economic pressures, technological change, and shifting collector behavior. As major artists like Jeff Koons realign their gallery relationships, these moves provide valuable insights into the future direction of one of the world’s most dynamic and influential cultural markets. For more insights on contemporary art trends, explore our coverage of emerging art movements and global gallery developments.