Millennial art collectors are experiencing unprecedented market transformation, but 2025 data reveals a shocking correction that’s rewriting everything we thought we knew about young collectors.

The $67 billion global art market is experiencing unprecedented transformation as millennial art collectors and Gen Z buyers fundamentally reshape how art is discovered, purchased, and owned. However, the story isn’t what industry experts predicted just two years ago.

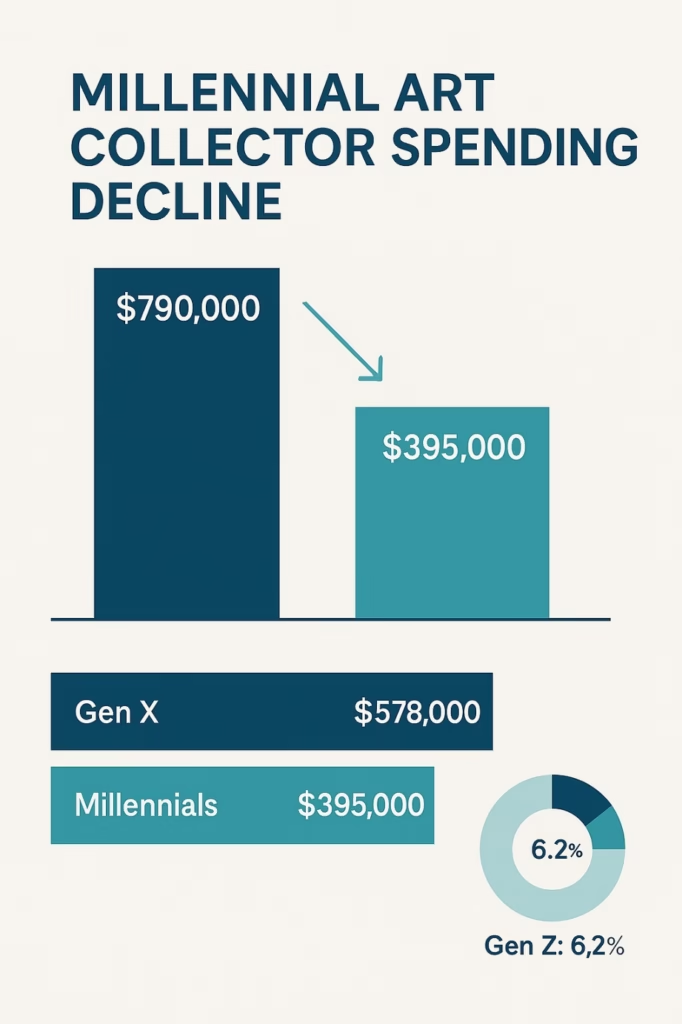

In a stunning market reversal, millennial art collectors experienced a dramatic spending crash of 50% in 2023, dropping from an average of $790,000 to just $395,000 annually. For the first time since demographic tracking began, Gen X has overtaken millennial art collectors as the art market’s biggest spenders, averaging $578,000 per collector. Meanwhile, Gen Z collectors—representing 6.2% of high-end buyers—are driving an 82% online purchasing rate and propelling digital art sales to a record $11.8 billion, now 18% of the total market.

This shift is also visible in how artists adapt their business strategies, as explored in our guide on how to turn your passion for art into a business, reflecting the changing dynamics between creators and collectors.

This generational shift represents more than changing preferences; it’s a complete reimagining of art collecting for the digital age, with implications extending throughout the entire art ecosystem.

The Millennial Art Collectors Market Crash: What Changed in 2025

Why Millennial Art Collectors Spending Plummeted 50%

The dramatic decline in millennial art collectors spending reflects a broader maturation from speculative to value-driven purchasing behavior. According to the Art Basel and UBS Global Art Market Report 2025, several factors contributed to this unprecedented correction.

Higher interest rates fundamentally altered the opportunity cost calculation for art investments. With risk-free returns exceeding 5%, art allocation dropped from 22% of investment portfolios in 2021 to just 15% in 2024. As Noah Horowitz, CEO of Art Basel, explains: “The downshift in millennial spending, being replaced by Gen X, is interesting. That starts unveiling some of the froth in the market coming from younger maybe more speculative buyers.”

The art market experienced significant bubbles in movements like “Zombie Formalism” and certain contemporary categories that particularly attracted younger buyers. Sebastian Gladstone, an established art dealer, notes: “For a while there, prices for some young artists didn’t make any sense.” Many millennial art collectors who entered during market peaks found themselves holding depreciated works, leading to more cautious approaches.

Rather than purely investment-driven purchases, millennial art collectors are increasingly prioritizing works that align with their social and cultural values. This shift toward sustainable, diverse, and socially conscious collecting has led to more selective, thoughtful acquisitions rather than volume-based buying.

Gen X Emerges as New Market Leaders Over Millennial Art Collectors

Gen X collectors now average $578,000 in annual art spending, representing a 3% increase even as the overall market contracted. This demographic brings several advantages including peak earning years with established career trajectories, market experience from observing multiple economic cycles, balanced approach between digital adoption and traditional collecting methods, and inheritance integration as they begin receiving family collections.

The millennial art collectors spending correction doesn’t signal retreat from art collecting—rather, it represents market maturation. Young collectors are making fewer, more considered purchases with stronger focus on long-term value rather than speculative gains. Research shows that 78% of millennial art collectors now spend 3+ months researching before major purchases, compared to 45% in 2019. Art advisor engagement among millennial art collectors increased 65% in 2024, indicating growing sophistication in collecting approach.

Digital Natives Drive $12 Billion Online Art Revolution

Social Media as Primary Discovery Platform

Perhaps the most transformative aspect of young collector behavior is how they discover and evaluate art. Traditional gallery relationships have given way to algorithm-driven discovery, fundamentally changing taste formation and market dynamics.

A remarkable 51.5% of Instagram users have purchased artworks from artists they first discovered on the platform. This represents a complete shift from traditional gallery-mediated introductions to artist work. Cross-platform behavior shows that 44% of Gen Z discover art through social media channels daily, while 46% of Gen Z and 35% of millennials prefer social media over search engines for product discovery. Additionally, 41% use TikTok as a search engine, with 77% utilizing it for shopping discovery.

Different platforms serve distinct purposes in the discovery journey. Instagram dominates with 89% of Gen Z usage, primarily for established artist discovery. TikTok has emerged as the platform for finding emerging artists and identifying trends. Pinterest serves as the mood boarding and collecting inspiration hub, while YouTube provides educational content and artist documentaries.

Ed Tang, former specialist at Sotheby’s and Christie’s, observes: “Young collectors are like sponges, absorbing all the information very quickly and seeing the value of having people advise them through it.” However, that advice increasingly comes from digital sources rather than traditional gatekeepers.

Platform-Specific Collecting Behaviors

Instagram has evolved into a complete art market infrastructure, with galleries, artists, and collectors conducting business through direct messages and Stories. Features like Instagram Shopping have streamlined the path from discovery to purchase. While still developing, TikTok’s impact on art discovery is accelerating. Short-form video content allows artists to showcase process and personality, creating deeper connections with potential collectors.

Specialized platforms like Artsy report that 57% of next-generation collectors discovered artists through online marketplaces, with 44% of their gallery buyers being new in 2024. This digital-first approach has created entirely new pathways for art market entry that bypass traditional gatekeeping mechanisms.

NFT and Digital Art Integration

Despite the broader NFT market correction, digital art collecting among young collectors has stabilized and matured. Current market statistics show that 83% of digital art collectors believe NFTs hold equal significance to traditional art. October 2024 NFT sales volume reached $356 million, representing an 18% month-over-month increase.

Generational preferences reveal that Gen Z allocates the highest percentage to digital art among all age groups, with 40% paying $101-$1,000 per digital artwork, indicating serious collecting behavior rather than speculative dabbling. Integration with traditional collecting shows that 67% of digital collectors also buy physical works, suggesting complementary rather than competitive collecting approaches.

From Speculation to Value: The Maturation of Young Collectors

Moving Beyond Investment Mindset

The 2025 market correction has accelerated a fundamental shift in young collector motivations. While investment potential remains relevant, it’s no longer the primary driver of purchasing decisions.

Rózsa Farkas of London’s Arcadia Missa gallery notes that young collectors “are often interested and invested in being a part of writing art history, of understanding the value of discourse inherent to our artists’ practices.” This cultural impact prioritization represents a significant departure from purely financial motivations.

Supporting emerging artists has become a hallmark of young collector behavior, with 52% of HNWI expenditure going to young and emerging artists in 2023-2024. This trend represents both values alignment and market opportunity identification, as younger collectors often discover artists before they achieve broader market recognition.

Rather than transactional collecting, younger buyers seek ongoing relationships with artists and galleries, often supporting careers over multiple years. This relationship-building approach creates more stable artist careers and deeper cultural engagement than traditional collecting patterns.

Values-Driven Collecting Priorities

Young collectors actively prioritize underrepresented artists, with particular focus on gender parity in collections, as 60% aim for 50% or more female artists. Racial and ethnic diversity serves as a conscious collecting criterion, while LGBTQ+ artist support and representation has become increasingly important. Geographic diversity beyond Western art centers also influences purchasing decisions.

Environmental impact increasingly influences collecting decisions through carbon footprint awareness for shipping and storage, sustainable materials preference in artwork selection, local artist support to reduce transportation impact, and circular economy participation through resale and sharing.

Social impact integration shows that 52% of young collectors use art for charitable giving, while 48% integrate purchases into tax planning strategies. This holistic approach to collecting reflects broader generational values around social responsibility and environmental consciousness.

Community and Social Impact Focus

Young collectors build networks through online collector groups and Discord communities, gallery young collector programs like Christie’s Young Collectors Club, art fair networking events specifically for next-generation buyers, and social media collector communities for sharing and discussion.

The integration of philanthropy reveals that 98% of young collectors integrate art into broader wealth management strategies, significantly higher than the 56% overall average. This sophisticated approach to collection building reflects both financial awareness and long-term cultural planning.

Technology Transforms How Young Collectors Buy Art

Fractional Ownership Revolution

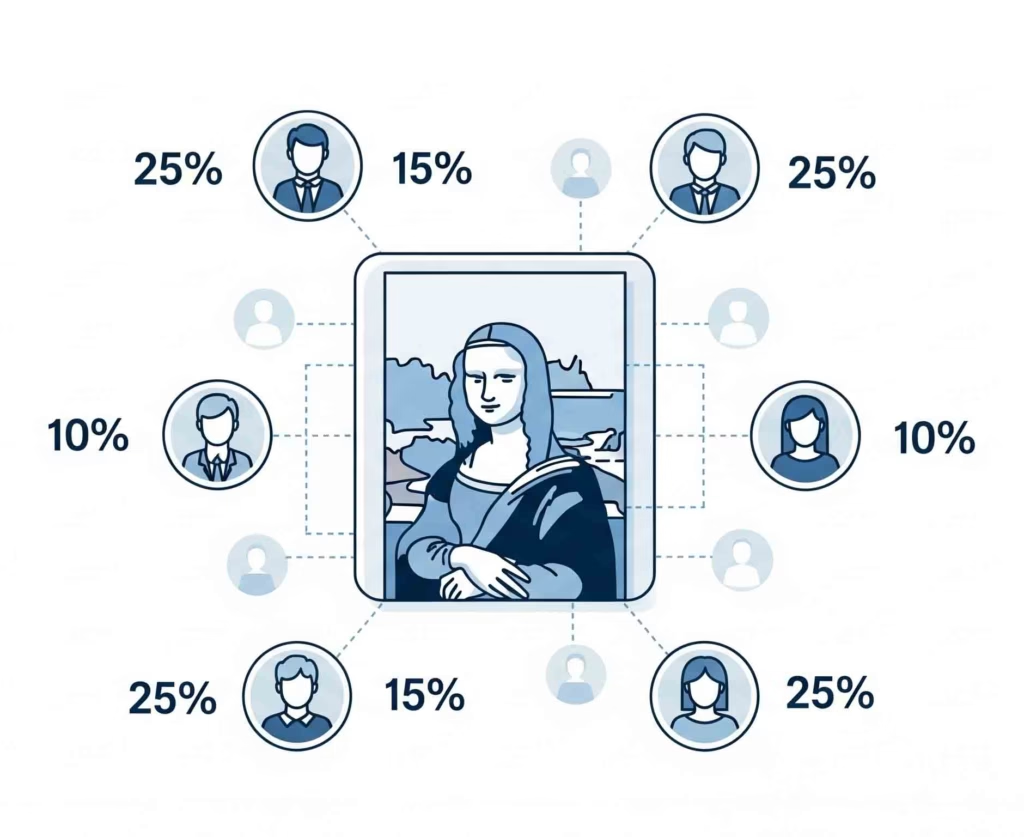

Alternative ownership models have exploded in popularity among young collectors, addressing both financial accessibility and risk diversification needs. Masterworks, the leading platform, now manages over $500 million in assets, with $1 million paintings often selling out within 1-2 days. The model allows collectors to own shares in blue-chip artworks previously accessible only to ultra-wealthy buyers.

Market growth trajectory shows fractional art ownership grew from essentially $0 in 2017 to $500 million in 2024, with projections reaching $5-10 billion within the decade. The collector benefits include reduced capital requirements for high-value works, portfolio diversification across multiple artists and movements, professional management and storage solutions, and liquidity options through secondary trading.

Beyond Masterworks, platforms like Arthena, Otis, and Rally offer varying approaches to fractional ownership, each targeting different collector segments and price points. This proliferation indicates market demand far exceeds current supply, creating opportunities for continued platform development.

Alternative Payment and Access Models

The Art Money financing revolution has transformed accessibility for young collectors through interest-free payment plan models. With 2,000+ partner galleries globally, the platform maintains a 90% approval rate with an average loan around $5,000. Notably, 25% of loans go to first-time collectors, indicating significant market expansion potential.

The model works by allowing buyers to take artwork home immediately while galleries receive payment within two weeks, solving cash flow challenges for both parties. This approach has proven particularly appealing to young collectors who prioritize immediate access over delayed gratification.

Subscription-based access models like Saatchi Yates’ membership program (£80-£800/month tiers) are gaining traction among young London collectors, transforming relationships from transactional to community-based. These models provide ongoing access to artworks and events while building collector education and market knowledge.

Rent-to-own programs through platforms like Curina offer monthly rental fees ($38-$148) with purchase options, particularly appealing to young professionals in expensive urban markets with limited wall space. This model allows for extended interaction with artworks before committing to purchase, reducing buyer anxiety and building confidence.

AI and Algorithm-Driven Discovery

Platforms are leveraging machine learning to suggest artists and works based on previous purchase behavior and browsing patterns, social media engagement and sharing activity, peer collector preferences within similar demographics, and market trends and emerging artist identification.

Young collectors increasingly rely on data-driven insights for artist career trajectory prediction using social media metrics, market timing for optimal purchase and sale decisions, authentication verification through blockchain and AI systems, and price trend analysis for investment planning.

This technological integration represents a fundamental shift from intuition-based collecting to data-informed decision making, though personal connection and aesthetic preference remain primary motivating factors.

Practical Guide for New Young Collectors

Budget Allocation Strategies by Life Stage

Early Career (Ages 22-28) typically involves monthly budgets of $200-$500 with focus on prints and multiples from emerging artists. Platform recommendations include Instagram direct purchases, Etsy, and smaller gallery online shops. The primary goal during this stage is building taste and knowledge foundation.

Established Professional (Ages 29-35) collectors usually work with annual budgets of $5,000-$15,000, allowing for a mix of emerging and mid-career artists. Recommended platforms include Artsy, gallery websites, and art fairs. The goal shifts to developing focused collecting areas and building meaningful relationships within the art world.

Peak Earning Years (Ages 36-42) enable annual budgets of $15,000-$50,000 or more, incorporating established artists and investment-grade works. Platform recommendations expand to include galleries, auction houses, and art advisors. The goal becomes building museum-quality collections with significant resale potential.

Platform Selection Guide

For discovery and education, Instagram remains essential for following galleries, artists, and art advisors for daily discovery. TikTok provides artist process videos and trend identification, while Artsy offers a professional marketplace with editorial content. YouTube serves as the primary source for artist documentaries and gallery talks.

For purchasing, entry-level collectors should focus on direct artist purchases via Instagram, Saatchi Art, and Etsy. Mid-level buyers benefit from Artsy, gallery websites, and specialized platforms. Investment-level collecting requires established galleries, auction houses, and professional art advisors.

Community building opportunities include gallery programs like Christie’s Young Collectors and Gagosian membership, online communities such as Reddit r/ArtCollectors and specialized Discord servers, and local events including gallery openings, art fair previews, and collector dinners.

Common Mistakes to Avoid

Financial missteps often include overextending budget in early collecting enthusiasm, ignoring additional costs like framing, insurance, storage, and shipping, buying purely for investment without personal connection, and not researching provenance and authenticity thoroughly.

Relationship errors commonly involve pressuring galleries for discounts as a new collector, not building long-term relationships with galleries and advisors, ignoring emerging market artists for “safe” established names, and failing to visit works in person before major purchases.

Knowledge gaps frequently include not understanding market cycles and timing, ignoring conservation requirements for different media, inadequate insurance and security planning, and not tracking collection value and provenance documentation properly.

Expert Predictions: The Future of Young Art Collecting

Wealth Transfer Impact ($84 Trillion Coming)

The art market stands at the precipice of the largest wealth transfer in human history, with $84 trillion expected to change hands over the next two decades. This transfer will profoundly impact how young collectors access and interact with art.

Current data shows 91% of wealthy collectors hold inherited art, with 72% retaining at least some pieces. However, younger inheritors often have different tastes and financial priorities, creating unprecedented market opportunities. Collection disposition trends include partial sales to fund personal collecting preferences, museum donations for tax benefits and legacy building, family foundation establishment for ongoing cultural impact, and market recycling bringing historical works to new collectors.

As Charlotte Stewart of MyArtBroker predicts: “In 2074 – 50 years from now – the boomers and aging millennials that make up the vast majority of major collectors will be dead. Gen Z will be the prime collecting generation. The race to build a marketplace truly fit for this generation, and the next, is on.”

Technology Integration Roadmap

Major museums including MoMA, the Whitney, and Tate Modern are investing heavily in VR art experiences. For collectors, this technology will enable virtual gallery visits and artwork preview, augmented reality visualization in personal spaces, enhanced authentication through detailed digital records, and remote expert consultations and condition assessments.

Beyond NFTs, blockchain technology will standardize provenance tracking for all artworks, authentication verification reducing forgery risks, fractional ownership smart contracts and management, and cross-platform trading and ownership records.

Machine learning will revolutionize artist career prediction using comprehensive data analysis, market timing recommendations based on historical patterns, personalized curation matching collector preferences with available works, and investment optimization balancing aesthetic and financial goals.

Market Structure Evolution

Traditional gallery structures are adapting to young collector preferences through transparency initiatives. Heath Flow, a New York art advisor, notes: “Truly engaging millennial collectors requires galleries to rethink ideas of transparency, flexibility, diversity, and sustainability. The gallery business model must adapt to consider these elements.”

Successful galleries are integrating online viewing rooms with high-quality digital experiences, social media engagement strategies beyond basic promotion, educational content creation for collector development, and community building through events and programming.

The traditional gallery gatekeeping model faces challenges as 51.5% of Instagram users buy directly from artists first discovered on the platform. Artist social media sophistication reduces reliance on gallery promotion, platform democratization enables direct collector-artist relationships, and younger collectors prefer authentic connections over institutional mediation.

The Sustainable Future of Art Collecting

Environmental Consciousness Integration

Young collectors are increasingly incorporating environmental considerations into their collecting decisions, reshaping market practices across the industry. Collectors now consider shipping distances and transportation methods, storage facility energy efficiency and climate control, packaging sustainability using recyclable materials, and local artist support to reduce transportation impact.

Growing interest in eco-friendly media and non-toxic materials, recycled and upcycled artistic materials, digital art formats reducing physical resource consumption, and conservation-friendly works requiring less intervention reflects broader generational environmental consciousness.

Social Impact Integration

Young collectors prioritize local artist ecosystem development through consistent purchases, underrepresented artist support addressing historical market gaps, educational institution partnerships supporting art education, and non-profit integration using collections for social benefit.

International collecting patterns show Asian collectors average age 38 versus US average of 50, while Mainland Chinese collectors maintain the highest median expenditure at $97,000. Cross-cultural exchange through digital platforms and global fairs, combined with emerging market artists gaining international collector attention, indicates increasingly global collecting perspectives.

Building Your Collecting Journey: Action Steps

Foundation Building (Month 1-3)

Education and exposure should include visiting 2-3 museums monthly to develop visual literacy, following 50+ diverse art accounts on Instagram across different styles and periods, attending gallery openings in your city to observe collector behavior, and reading art publications like Artnet News, Hyperallergic, and ARTnews.

Budget establishment involves calculating realistic monthly art budget (typically 1-3% of income), researching additional costs such as framing ($200-$500) and insurance ($100-$300 annually), setting up dedicated savings account for art purchases, and considering payment plan options through platforms like Art Money.

Active Engagement (Month 4-6)

Relationship building should focus on introducing yourself to gallery staff during visits, attending art fair preview events if accessible in your area, joining young collector programs at major auction houses, and connecting with other collectors through social media and events.

First purchase strategy involves starting with works under $1,000 to minimize risk while learning, focusing on artists you genuinely connect with rather than investment potential, buying from reputable sources with clear return policies, and documenting everything for insurance and provenance records.

Collection Development (Month 7-12)

Sophistication building includes working with an art advisor for larger purchases (typically $5,000+), developing focused collecting areas rather than random acquisitions, considering conservation requirements for different media types, and planning storage and display solutions for growing collection.

Long-term strategy involves setting collecting goals for 3-5 year timeline, building relationships with 2-3 preferred galleries, considering resale potential while prioritizing personal connection, and documenting collection with professional photography and detailed records.

Conclusion: The Art Market’s Digital Renaissance

The transformation of art collecting by Gen Z and millennials represents more than a generational shift—it’s a fundamental reimagining of how art functions in society. Despite the surprising 2025 market correction that saw millennial spending decrease by 50%, the underlying trends toward digital integration, values-based collecting, and community building continue to reshape the industry.

Technology will continue disrupting traditional models through social media discovery and fractional ownership, democratizing access to art collecting previously reserved for ultra-wealthy buyers. Values drive purchasing decisions as young collectors increasingly prioritize diversity, sustainability, and social impact over pure investment returns, creating new market opportunities for artists and galleries aligned with these values.

Community matters more than status as the traditional model of collecting for social signaling has given way to genuine community building and cultural participation. Education and transparency are essential as young collectors demand information, education, and transparent practices from galleries and institutions, forcing market-wide adaptation.

As we move toward the largest wealth transfer in human history, with $84 trillion changing hands over the next two decades, the art market must continue evolving to serve a generation that thinks differently about ownership, value, and cultural participation.

The future belongs to those who can bridge traditional art world expertise with digital native expectations, creating collecting experiences that are simultaneously accessible, educational, and socially impactful. For young collectors entering this transformed landscape, the opportunities have never been greater—but neither has the importance of approaching collecting with knowledge, intention, and community support.

The art market’s $67 billion ecosystem is being rebuilt from the ground up by collectors who see art not just as investment or decoration, but as a fundamental part of how they engage with culture, build community, and shape the future. This is not just a market trend—it’s a cultural revolution that will define how art functions in society for generations to come.

Ready to start your collecting journey? Begin by following key art accounts on Instagram, visiting local galleries, and connecting with other young collectors in your area. The future of art collecting is being written now, and you have the opportunity to be part of shaping it.